3 PE Firms are Loving What This Company Does

A Shriram Housing Finance Limited's fundamental analysis story

Hello Guys 👋,

I recently read a news article about an ongoing discussion related to acquisition of Shriram Housing Finance Limited (SHFL).

3 Private Equity Firms —Bain Capital, Advent International, and CVC Capital— are competing to own SHFL from Shriram Finance.

Shriram Finance owns 84.82% stake in SHFL. As per the article,

According to sources cited in the report, the financial company is estimating a business valuation of Rs 6,500 crore, which includes a control premium. However, initial offers have fallen within the range of Rs 5,000-5,500 crore.

In today’s post, we will try to understand the business at a high level, and we will try to make an attempt to value it too.

Side Note: Seems like Warburg Pincus is also a leading contender.

Disclaimer: I am not a registered agent. Nothing in the article is investment advice in any form. This is purely a mathematical exercise.

Let’s begin.

In my last post, I tried to value Unilever India in detail. You can check the last post here. The stock was trading at a PE of 51.6 😅

I would be more than happy to know how can the intrinsic value and current market price align better. Your suggestions and thoughts are welcome.

SHFL was incorporated in the year 2010.

It has two major shareholders—Shriram Finance(~84%) and Valiant Capital Management(~15%).

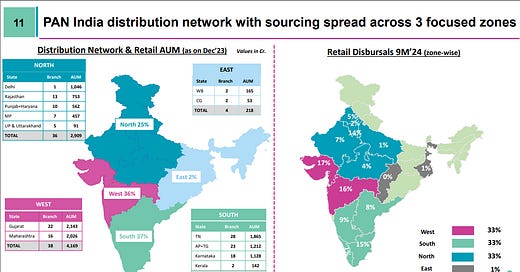

It has around 12,000 Cr Assets Under Management, and is covering all major states of India (~16) with a total of 149 branches.

It had an amazing 4-year period from 2020-2024. Its AUM and disbursal have grown at exorbitant rates (68% and 86% respectively), and the PAT (Profit after tax) has grown at a CAGR of 69% in the last 4 years.

Now, the question is, why are the 3 PE firms fighting for a company in affordable housing space?

I think this space is 🤑 and secure.

Why secure? Well, the loans are against property. If the value of the appraised property is 1.2x, 1.5x the loan amount, it becomes a very secure lending model.

And to top it off, Indians are crazy about owning houses and building houses.

For people living in tier-2, tier-3 cities, owning a house comes with its own kind of pride. People cannot see your investment portfolio, but they can see your house, and that is where most people derive a bulk of their pride.

This feeling is still shared by many in metropolitan areas too. Owning a house or an apartment gives one a sense of security.

I had written about Aavas Financiers, a player in the affordable housing space, earlier. Read here. Some excerpts from the post to visualize the size of the market are as follows:

Affordable Housing Finance Market Size

The outstanding mortgage loans are estimated to be around $360 billion, ~10.6% of the Indian GDP of around $3.389 trillion in FY22. The mortgage loans to GDP ratio of a few countries, including India, is as follows (Aavas’s annual report FY22-23):

The affordable housing finance size is estimated to be around $51 billion with an estimated growth rate to be around 15%. Assuming India’s GDP growth rate to be constant at 8.9% and mortgage loan book growth to be at around 13%, the following image paints the picture for us with numbers for the next 10 years.

This study was from 2022 during which USD/INR rate was around 73. If I assume the rate to be the same, The AUM of SHFL would come to be around ~$1.6 billion. Affordable Housing Market in 2024 was projected to be around $67 billion, making SHFL share to be around 2%.

Big market, a small market share of SHFL, and its amazing business fundamental are making these PEs really interested in the opportunity to own SHFL.

Now, coming to the main question, what should be the value of SHFL?

Obviously, Shriram Finance would want to sell it at a value as high as possible, and the PE firms would want to minimize it as much as possible. This becomes a tug of war.

However, as a third party which is not involved in the transaction, we can try to evaluate this deal with as much of an indifference as possible, taking into account possible scenarios.

Now, SHFL is essentially a company in the finance domain. There are two ways to value a company in the finance domain:

Using Dividend discount model.

Using Excess Return model.

We will use the second approach here. You might feel now:

What is an Excess Return model?

Imagine a farm where you have lots of bees.

The farmer tends to the bees and flowers, collects honey, and sells it off in the market.

These different flowers make the honey from his farm super delicious and sweet.

Now, during normal working condition, he would take the honey, sell it off at a profit, and use the profit to buy more land, buy different kinds of flowers, fertilizers etc. His business would keep on expanding—more land, more bees, and more variety of flowers.

Now, as long as, the revenue for the sale of honey is more than the costs of maintaining his farms, his business will keep on flourishing/expanding.

If they are equal, his farm size, flower variety, and bee population would become stagnant/stable.

If costs increase, but profits shrink, the business would shrink till it reaches a stable point.

In the same way, If the cost of equity is less than the return on equity, the book value of equity i.e. the business value in our bee example would keep on increasing.

If cost of equity === return on equity, the book value of equity will freeze, i.e. our business will freeze in value.

We will use this methodology to value SHFL now.

The last 12-trailing month net income of SHFL was Rs 19251.47 Lakh. The Book Value (BV) of Equity at the end of FY 2023 was Rs 1,29,918.74, giving us the Return on Equity (ROE) of 14.82%. (What is BV of equity? Well, think of it as the value of business to all shareholders)

Now, if you have understood my bee example, you would have thought - “Okay! What is the cost of equity (COE) now?”.

Let’s calculate that.

We need the following ingredients to calculate it:

Risk-Free rate (RFR)

Beta for the firm

Equity Risk Premium (ERP)

We will use the risk-free rate of US at 4.20% and ERP of India at 7.39%. We just need to find the Beta for the firm now. (Please refer to this post to understand how to get the cost of Equity and to understand levered/un-levered beta)

Since we are talking about a firm dealing in Finance industry, all firms are levered. We can simply use average beta of the firms in affordable housing industry to come up with beta for SHFL. (We should not use regression beta but instead avg beta, refer the post above to understand regression beta).

Using, the beta of 0.57, we get the dollar value of cost of equity as 8.41%.

In Rupee term, we get 10.53%. (The post mentioned few lines above explains how to convert cost of equity from $ to Rupee term).

Now, we have our COE too.

The difference between ROE and COE x starting book value (BV) of Equity == Excess Return.

ROE x Starting BV Equity == Net Income

COE x Starting BV Equity == Equity Cost

Excess Equity Return = Net Income - Equity Cost.

Now, as we proceed through the years, We will discount each year’s excess equity return using cost of equity to get present values. We sum all present values from year 1 to year 10, and add it to 0th year (or current year) BV Equity.

For example:

0th year or current year BV Equity is Rs 129918 Lakhs.

For year 1,

the starting BV Equity will be : BV Equity is 0th year BV Equity + Retained Earnings ( Net Income: we not paying any dividends here) = 149170 Lakhs

Cost of equity (10.45%) x BV Equity( 149170)= 15580 Lakhs

Return on Equity(10.22%) x BV Equity( 149170) = 15245 Lakhs

The difference is Excess Return of Rs -335.78 Lakhs. Discounting it by COE for year 1 i.e (1+10.45%), gives us Rs -304.03.

We will then add the retained earnings(Net Income ) of year 1 to starting BV of year 1 to get starting BV of year 2.

I hope you all got the logic here. 😅

So, Yes, this is how you do Excess Return Valuations.

Now, all valuations are nothing but a romance between stories and numbers.

We can tell a really beautiful story and try to get very high valuations. If it were a non-finance firm, we would have woven a story which could make even the movie Interstellar sweat 😂 but alas! we are valuing a finance firm.

So, what is the story here?

Well, our first character is cost of equity. We can hardly play with it.

The maximum leeway we can give ourselves would be that in terminal year (Since we will assume a 10-year window post which the growth rate in earnings we will assume to be equal to risk-free rate), the ERP would decrease from 7.81% to 4.18% as the India matures as a market.

Now, the only other remaining character is ROE. The current trailing twelve months(TTM) ROE is 14.82%.

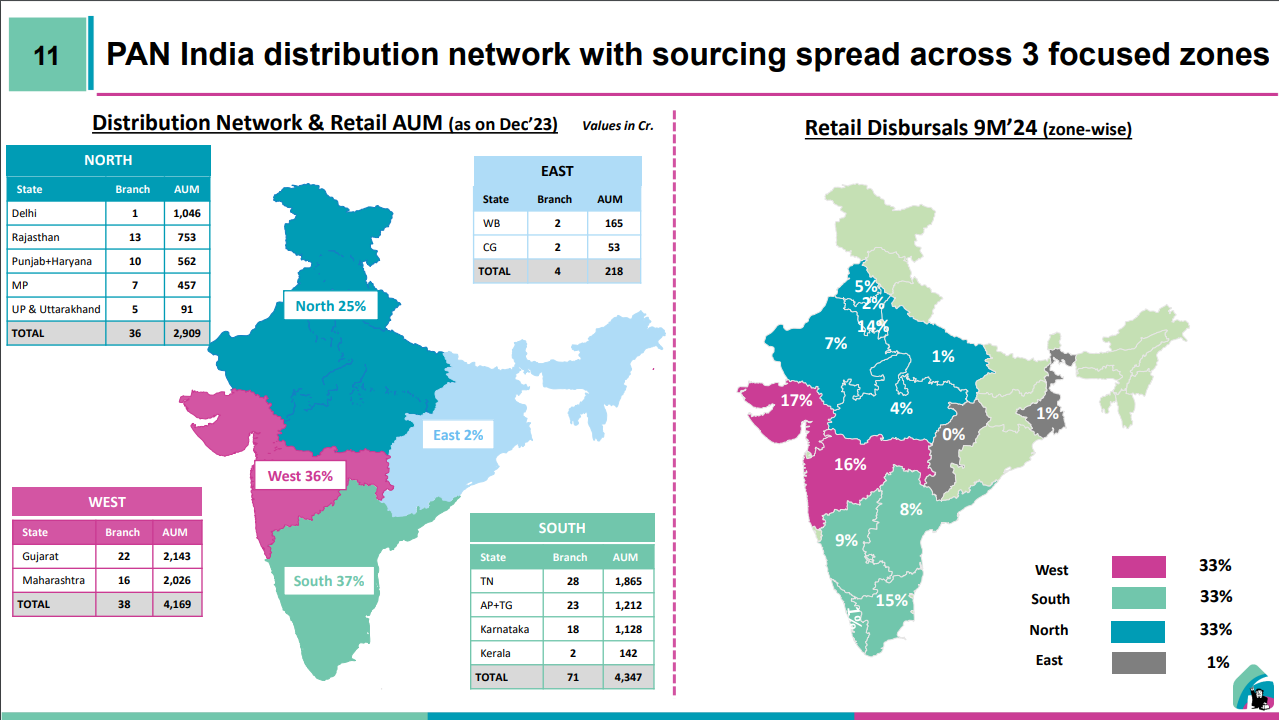

The ROEs across 20 companies in affordable housing space in India are as follows:

We can weave 4 stories around this:

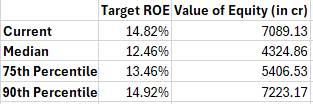

ROE stays the same as current year’s forever at 14.82%, giving an equity value of Rs. 7089.13 crore

ROE moves from current 14.82% to median at 12.46%, giving an equity value of Rs. 4324.86 crore

ROE moves from current 14.82% to 75th Percentile 13.46%, giving an equity value of Rs. 5406.53 crore

ROE moves from current 14.82% to 90th Percentile 14.92%, giving an equity value of Rs. 7223.17 crore

So, What stories are the PE firms telling themselves?

For them to propose 5000-5500 crore valuation, they are saying that the firm should move down from its current ROE of 14.82% to a median range or 13.46,% and this ROE is doable.

For Shriram Finance to ask for Rs 6000-6500 crore valuation, it believes that the SHFL, with a very focused management, should be able to juice out a ROE closer to 14.5%-14.9% range in the long term.

In the news article ( if you have read it), Shriram Finance is asking for the mentioned amount citing reasons of “control premium”.

Now, what is control premium?

Lets go back to our honey business discussed above.

Assume the case that I am a genius scientist, and I have pioneered a way to grow different variety of flowers with 50% less fertilizers and 20% less land space.

I come to you and ask you to sell me your natural honey business with all its assets for $1 million.

Now, What I will do is carryout another calculation with me running your business, using my new efficient techniques - 50% less fertilizers and 20% less land.

Say the worth of your business under my leadership is $5 million.

The difference of $4 million is my control premium i.e. If I run the business, I can juice out $4 million more using certain levers.

So, here if Shriram Finance is saying that they are valuing SHFL at Rs 6000-6500 crore, including control premium.

What I guess they are saying is that under the PE firm there could be certain unlocking of value which could drive the ROEs higher - it could be reducing expenses related to offices, people etc, or bringing the cost of borrowing lower somehow?! or it could be a more effecient way of lending reducing non-performing assets further.

And, hence, Shriram Finance believes the right price for SHFL is the amount they are seeking.

Again, this is a conjecture. I am not sure what they are exactly looking at.

Anyway, This space is hot and competition is brewing up with banks as well. Valuing the business with a story that it will be able to maintain the 75th percentile value of ROE eventually in stable state could just “may be” the correct approach 😅.

I hope you found my post interesting and insightful.

Thank your for reading.

See you in next post.

Note: Excel workings for you all to play around with.