This Bank Survived ~Rs 4000 cr In Losses

A fundamental analysis of IDFC First - favourite stock of many investors - and its story of evolution

Hello Guys 👋,

Another day, Another fundamental valuation.

Today, we will try to understand IDFC first story. How it survived like a true phoenix.

I hope you really like reading my valuation posts. I try to make it as informative and entertaining as possible.

I understand that at times, the information may seem daunting. You might feel overwhelmed.

Your brain would say - “Bro! stop it. Cannot take it”.

But remember:

“difficult journey of climbing a hill pales incomparison to the view the hill shows from top”

Note: I am not a registered analyst. This is purely a mathematical exercise. You are free to download the Excel workings, edit, re-work and do whatever you wish with it.

My last post was slightly different.

A reflection on what I would want to tell a 20 something myself if I could write him a letter. Check here. Hope you find it worth reading.

Banks are exceptionally boring businesses.

There is nothing sexy about being in the banking business.

The model is centuries old. You take money, you lend money, and you make profit based on the differential rate of lending and borrowing. That is it.

This unsexy business has many players in India, and one such player is IDFC First Bank.

Let us understand how IDFC First came to be.

Origins

IDFC First Bank is an outcome of a merger between two institutes, both seeking something which they didn’t have.

A true love story—one entity with licence to bank, but no expertise in retail space lending (essentially lending to common folks such as you and I), and the other wanting to lower its cost of funds by getting a chance to take deposits from retail consumers such as you and I.

IDFC Bank and Capital First bank merged to form IDFC First Bank in December 2018.

But it had its own share of issues post merger:

There was very low CASA contribution (~8.68% of all deposits)

CASA means Current and Savings account. It is a cheap form of money for any bank.

Current, 1 year Govt bond gives you around 7% yield, i.e. invest 100 and get 107 next year.

India’s 3-month bond(bill)yield is around 6.8%.

But, if you open a current account with a bank, the banks give 0% in return, and for savings account around 3-4%. Since, the banks pay you lesser yield compared to what government would have (if you would have simply bought government bonds), it is cheap money for the bank.The Bank post merger had NIM (net interest margins) at 1.9% and pre-provisioning operating profits at 0.32% (reported at September 2019).

Net Interest Margin is the difference between interest income and interest expense.

For Example: Say I give you a loan for 100k and want you to pay 5% as interest. Now, I might have taken the same amount as a loan from someone else at 2%.

My interest income here would be 5k and expense would be 2k, giving the net interest income as 3k. Since my asset here was 100k, which i had loaned to you, my net interest margin becomes 3k divided by 100k == 3%. I hope you got the maths.

Now, if from the 3k above, I subtract my expenses (such as my salary or my office space etc), I get pre-provisionings operating profits. Say this expense was 1k, my pre-provisioning profits become 2k now.

What is provisioning? Well, I need to keep certain capital aside per year incase you default on the loan right? So, yes that is called provisioning in banking. Every Banking company needs to do that.The Bank had almost 91% of loans as institutional loans and borrowings, and also had a large exposure to infrastructural and corporate loans.

Banks needs funds to give loans.

There are two sources of funds: 1) Borrow money from some other banks, institutes or government, or 2) Borrow money from equity shareholders.

Now, if you are an institute giving loan to a bank. How much interest would you charge?Well, more than what the government bonds are giving, right?

If government bonds and the bank (you lending money to) are giving 7% as yield, why would you risk your money by giving a loan to a bank? Bank can go under, government bonds are much safer.

Hence, for giving the loan to the bank, you want > 7%. May be you may charge them as interest 8% (a premium of 1% since they are riskier than a government)

Got the logic.

These institutional borrowings become an expensive source of funds. You want CASA money coming in. Also, you want to have really manageable exposure to infrastructure or corporate loans.

Why?

Well, all good corporates will try to get cheaper loans. They will approach likes of HDFC bank or SBI Bank.What you will be left with would be Corporates with okayish or not so okayish ratings and they might default.

Now, coming back to our pre-provisioning operating income. What would happen if a big loan defaults?

Your equity of shareholders will get wiped off. Your lenders will come after you. Government will sit on your neck.

So, yeah, IDFC First Bank had some of these major pressing issues.

Their love story needed better operations, and some major 💰💰. At this moment, the love was not enough to sustain 😅:

Money isn’t the most important thing in life. But it is quite close to oxygen on “gotta have it scale” - Zig ZiglarIDFC First did the following immediately:

Slowed the loan book growth rate to a mere 5% rate for 3 years between (2019-2022)

Increased focus on getting cheap capital aka CASA, and slowly increasing the retail deposits to 79% of customer deposits.

Bank raised Rs 3000 crore in from shareholders.

And it worked.

PAT (Profit after tax) increased from loss of Rs -1908 crore in FY 19 to Rs. 2437 crores in FY23.

In 9M-FY24 i.e. till December 2023, the Bank has posted PAT of Rs. 2,232 croreTheir GNPA is 1.45% and Net NPA is 0.51% in December 2023.

What is GNPA? Well, remember our earlier example of me giving you loan. If you default for 3 months on interest payment, I need to tag you as my GNPA (Gross Non Perfermonig asset)

Each year I made provisions from my net operational income earlier, right?

These provisions I subtract from GNPA to get Net NPA. The lower this number, the better the bank’s lending process.GNPAs of few known banks, which I had calculated to do fundamental analysis for Aavas Housing Finance. Check the valuation here

Reflections And Vision

Recently, the bank issued a guidance on what they wish to achieve in the next 5 years from FY 24 - FY 29 and reflected on what they achieved in past 5 years from FY19-FY24. (All information cited in the post is from their ppt)

Between 2019-2020, The bank had to write off around Rs 2000 crore because of many legacy loans like Dewan Housing Finance, Reliance Capital, Cox and Kings, and infrastructure loans.

This wiped off a lot of net-worth, i.e. shareholder equity.

They had to go and raise money from shareholders to stabilize their loss of shareholder equity.

This is needed because all banks have to maintain a minimum % of value in shareholder equity relative to their assets (i.e. loans given out to people, companies etc). It is called regulatory capital.

They did a commendable job in achieving what they had decided to achieve based on “Guidance 1.0” provided in 2019 by management.

This slide (Fig1) from their ppt shows their performance.

They improved the customer deposits i.e. deposits in form of CASA by 4.5 times, same with CASA ratio

Their branches and loan asset base (i.e loans given out to customers) also had a significant jump.

One of the most important thing was 6.2x jump in ROE.

ROE is return on equity. Think of it as $100 worth of shareholder value in the bank generated $10 in net income after every expense is taken care of. This number for a bank or a company is low, according to me, but from 1.72% to 10.67% is a commendable job.

Their “Guidance 2.0” i.e. the direction and state the management wants the bank to be at by March 2029 is as follows in Fig 2. Most of the terms are self-explanatory:

ROA is called return on assets.

What are assets for a bank?

Well, all it given out loans and advancement to various customers, or loans to other banks (yes, banks interlend each other). That is banks are not allowed to fail.

If one fails all fail in a way causing severe strain on financial stability of the country.

What are term deposits? Well, Fixed Deposits openened with the bank for a year long period or so.

With profits in the range of 12000–13000 crore, it wants to be closer to Axis Bank in profit making capacity. Axis Bank has a market cap of around 330,000 crore, whereas IDFC has around 60,000 crore.

If we work under the assumption that the current market cap reflects the profit generation capacity of the banks, IDFC First is essentially aiming to 5x its market cap.

The bank’s performance from December 2022 to December 2023 is as follows:

I have already explained all the terms, so far. The only new term here is “Provision Coverage Ratio”.

Provision coverage ratio is the ratio of provisions made divided by the current GNPA.

Think of it as what amount of the provisions I have kept aside so far so to cover my gross non-performing assets. The higher, the better.

Key takeaways from Fig 3:

Assets have grown by around 25%

Profits have grown by around 26%

GNPAs and NNPAs have decreased—lesser strain on the bank loan book now.

Provision coverage has increased—the bank has set aside capital to cover loan defaults, the shareholder’s equity will not have to face the brunt of default much.

Aspiration

IDFC first bank is just 0.92% of the total Indian Banking Deposit size.

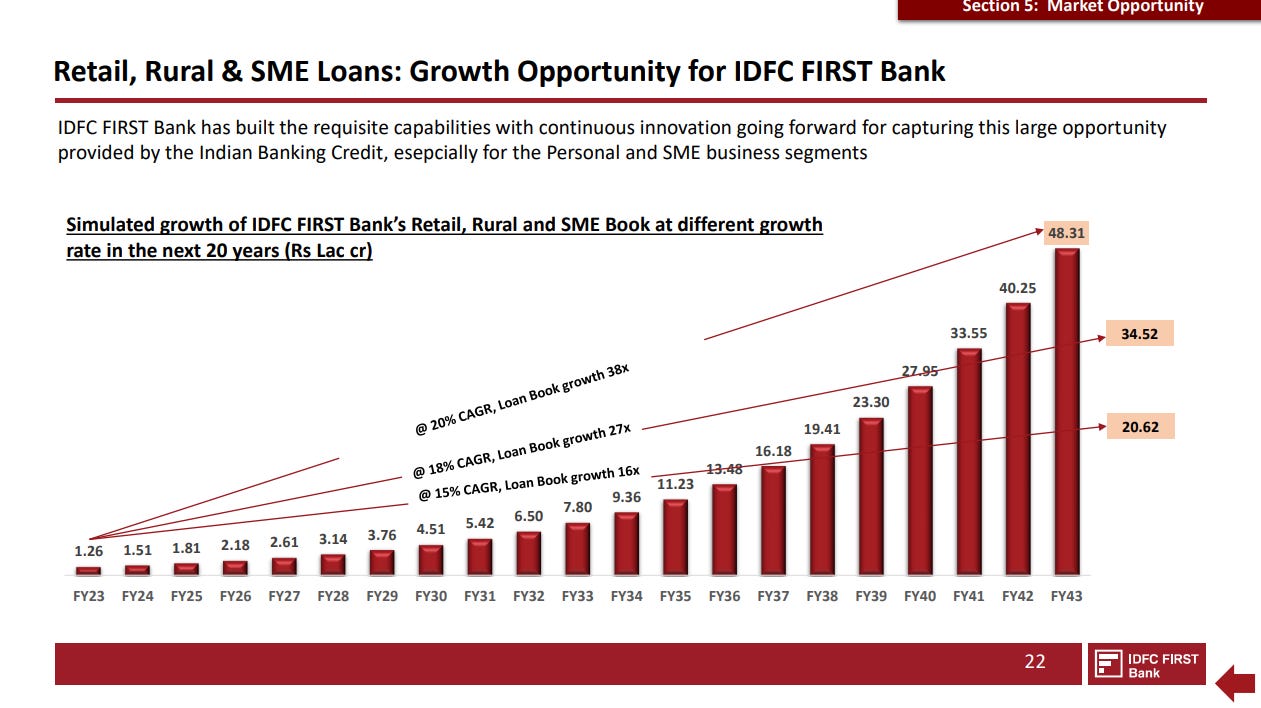

The market size of loans as per their report (Fig 5) will be Rs 1288 cr by FY43. These include all kinds of loans - retail, rural and SME loans

As per IDFC first, the loan market would grow 15x from FY23 to FY 43 i.e. in next 20 years.

IDFC First did a kind of simulation to show how their loan book will grow at different CAGR (Compounded Annual growth rate) in Fig 6

Remember, we are in unsexy business of provided loans. This is the only way banks will or can grow.

What IDFC First is saying that they will be a mere 3% i.e. 48/1288 ~ 3% in best case scenario 😱

The market is HUGE!!

For any company—be it bank or non-bank, we need to check what size of the market are they capturing. This is one of the key things to look out for when projecting growth.

Understanding The Business

In understanding a business, we need to know the following:

How much is the business earning or generating in revenues? What is the growth like?

How much is the business incurring in costs? Are the costs decreasing?

How are the profits coming along? Are they increasing every year?

For our business of focus today, all income comes from the loans given out and some from add-on services such as ATM charges, other transaction charges etc.

So, let’s have a look at how the loans are distributed. We would want the bank’s loan portfolio to be as diverse as possible.

IDFC First loan book is well diversified (Fig 7) , as was its aspiration discussed earlier.

The the diversification in Fig 7 fetched IDFC the following interest income over the years ( Fig 8)

The interest income had a CAGR of 27% over the last 4 year, and it increased by 33% from December 22 to December 23.

Now, all income generated comes at a cost. Cost could be from employee expense, cost incurred in building branch infrastructure or put in developing technology.

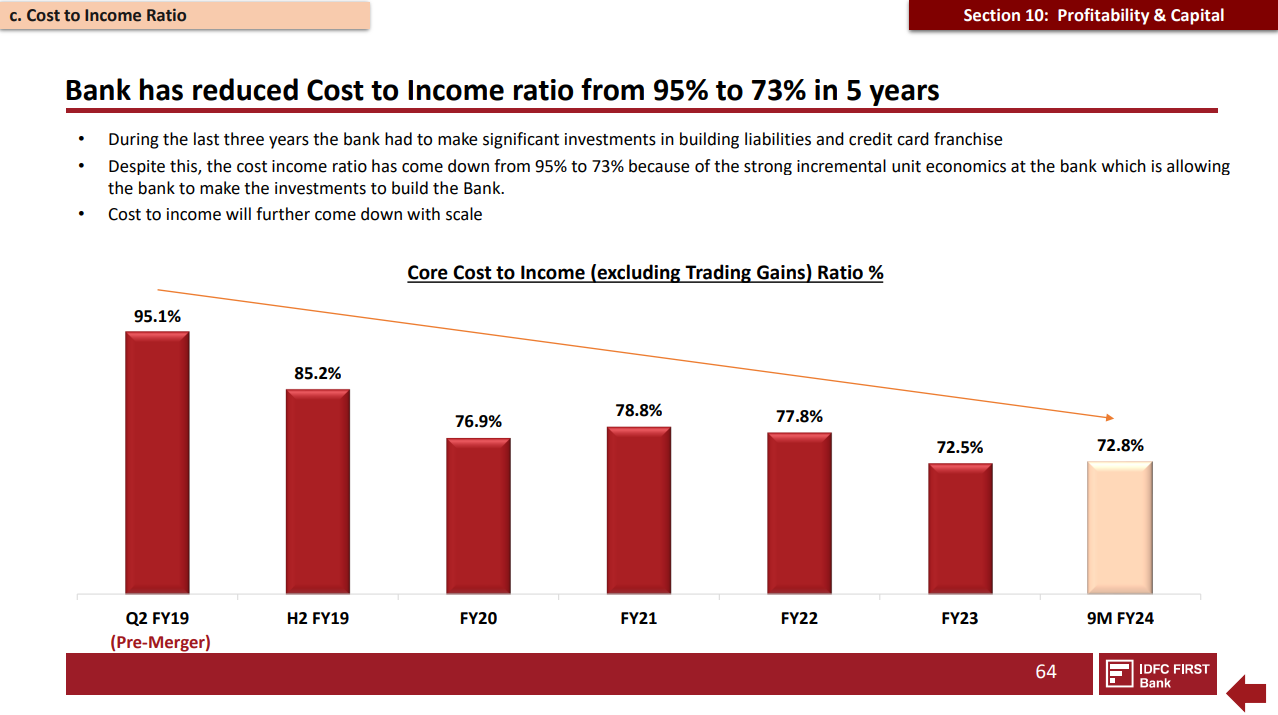

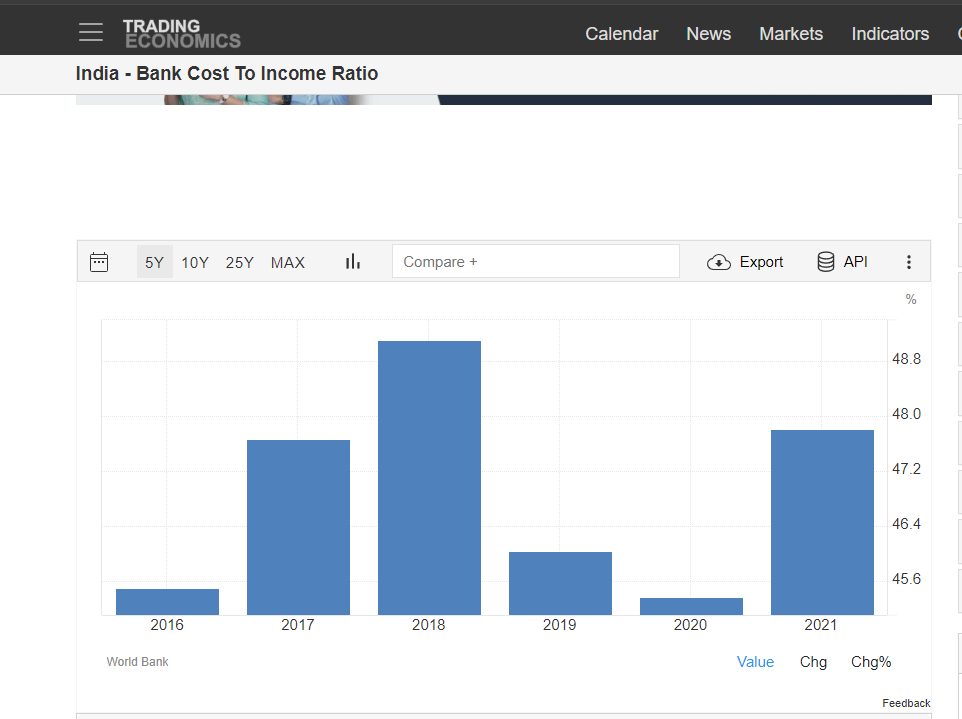

We would ideally want the cost to income ratio to keep on decreasing each year.

IDFC First’s cost to income ratio has been falling continuously over the years (Fig 9).

This would mean that for every penny expensed by the bank, it was able to generate a lot more in income.

It still higher compared to other banking players in the market though (Fig 9 vs Fig 10)

Given, all the parameters moving in IDFC First favour, the Pre-provisioning Operating income was ought to move accordingly as shown in Fig 11.

The Pre-Provisioning Operating profits grew at a CAGR of 43%. From December 22 to December 23, it grew by 35%.

Now, you know the IDFC First story. The chaos it faced and the performance it delivered.

All this was made possible by amazing leadership of its CEO and its management.

It is always nice to put a face to the leaders who worked behind the scenes focusing on what they do best, i.e. LEAD.

Please do read about Mr. Vaidyanathan, CEO, IDFC First.

Such leaders are nothing but exceptional.

My best wishes to him and his team.

Valuation

So, we have read in detail about IDFC First and how it came to be, its struggles and wins.

Let’s try a fundamental valuation of IDFC First.

Again, like I have mentioned in the past, Finance companies can be valued either using:

Dividend Discount Model

Excess Returns Model

Regulatory Capital Reinvestment Mode.

We will use here Excess Returns Model to do the valuation. (If you do not know what is Excess Returns Model, Check my old post out. I have explained this in detail using an example. Read here)

So, the first thing we want to know is our Cost of Equity.

We will consider a 10Y window, as discussed in my old post, and assume a terminal year post that.

The cost of equity is as follows:

Next, we need to figure our target ROE in stable year.

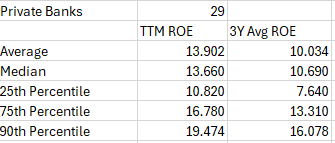

For this, I checked the latest trailing 12 months (ttm) ROE and 3Y ROE of publicaly listed 29 private banks. The result is as follows:

Now, what is the story you want to weave here?

What would be the target terminal year stable ROE for IDFC First.

For calculation sake, I assumed the following 5 stories:

Story 1: The current ROE continues till terminal year, giving Rs 44.66as value per stock.

Story 2: The latest ttm median ROE is stable terminal year ROE, giving Rs 76.49 as value per stock.

Story 3: The avg 3Y median ROE is stable terminal year ROE, giving Rs 30.79 as value per stock.

Story 4: The ttm 75th percentile ROE is stable terminal year ROE, giving Rs 144.78 as value per stock.

Story 5: The avg 3Y 75th percentile ROE is stable terminal year ROE, giving Rs 70.22 as value per stock.

Story 6: The guidance of IDFC First in Guidance 2.0 is terminal year ROE, giving Rs 178.43 as value per stock.

Currently, the stock is trading at Rs 84.40.

Choose your story.

I hope you found this post interesting.

Thank you for reading.

See you in next post.

Note: The following is the Excel working for IDFC First. I have used Excess Returns Model (Explained in detail here.